A route-to-market or go-to-market is a plan of an organisation using their inside and outside resources, such as a sales force and distributors, to deliver their products to the outlet base and services their customers. A route-to-market (RTM) plan is a strategic document that outlines the steps and actions a company (e.g. consumer goods) will take to distribute and sell its products to customers.

The plan typically includes information about the distribution channels, sales strategy, customer segments, channel partners, logistics, and marketing tactics that the company will use to reach its target market. The goal of a RTM plan is to ensure that the company’s products are easily accessible to customers through the most efficient and cost-effective channels, while maximising revenue and profitability.

An RTM plan is an essential component of a company’s overall business strategy, as it helps the company to understand how to reach its target market, what channels will be most effective and how to optimise distribution to maximise sales and revenue.

What factors do you need to take into consideration?

To develop a route-to-market plan, you need to take into consideration internal and external factors. In emerging market countries, special attention should be given to key issues such as infrastructure and regulatory environment that could affect your route-to-market design and implementation.

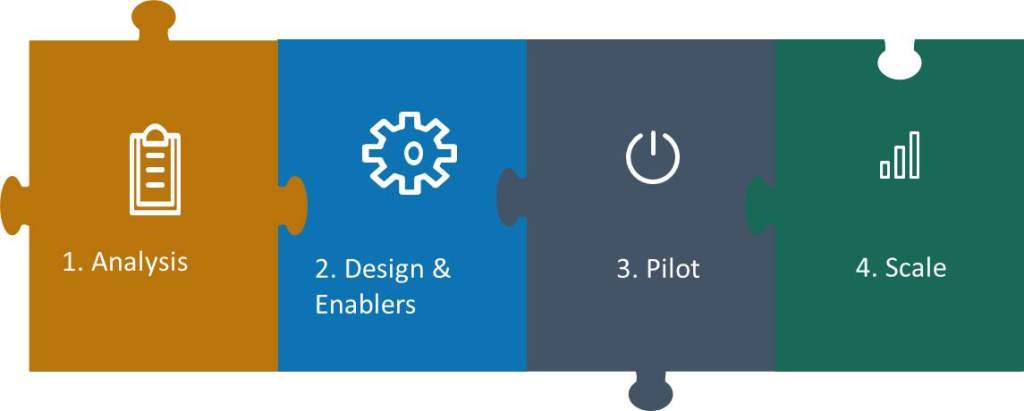

Four phase approach

The Supply Chain Lab divides the design and roll-out of a route-to-market plan into four phases. Each phase comprises several building blocks, supported by analysis tools and key enablers.

1. Analysis

The first phase focuses on the analysis of consumers, channel, competitors, logistics providers, distribution partners, infrastructure, regulatory environment, and external stakeholders. The Supply Chain Lab uses several tools during the analysis phase, and we will discuss a few below. For the complete tool list (18 tools) and route-to-market framework, see our Route-to-Market Presentation, including the purpose of each tool, when to use it, how to use it, and material requirements.

Route-to-market analysis steps

1.1 Product: When developing a product for emerging markets, it is essential to understand the needs of your targeted consumer and offer a product that meets those needs at a price that represents value. Cash is still the king in most emerging markets, so it’s essential to take into account affordability and the amount of money that consumers have in their pocket. Additionally, it’s important to consider the cultural and societal norms of the targeted market, when developing or introducing a product in the market.

1.1. A) Product Analysis Tool: The ranking values tool or Value Driver Tree (VDT) is a ranking values tool that studies the value drivers of a product or service. It is a visual representation of the factors that drive customer value for a particular product or service and breaks down customer value into different levels of value drivers. The VDT helps to identify the most important drivers of customer value and prioritise them in order to optimise the product or service. It also helps to identify areas where the product or service can be improved to better meet customer needs and increase customer satisfaction.

1.2. Consumer: It is essential to conduct in-depth research to understand the consumer when developing a product or marketing strategy. This includes determining who your consumers are, their demographic information, their purchasing habits, and their attitudes towards your brand and product. Understanding when and how consumers use a product can also provide valuable insights on how to optimise the product and target the right audience at the right time.

1.2. A) Consumer Analysis Tool: Consumer insights (CI) research focuses on the attitudes, beliefs, and behaviours that drive buying decisions. They help the company to understand what their customers want, need, and expect, and how they make purchasing decisions. Consumer insights inform the company’s product development, marketing, and sales strategies, as well as help them to identify new opportunities and areas for innovation. They are typically gathered through a variety of research methods such as focus groups, surveys, interviews, and online analytics. Brand teams work with CI to create the right product message aligned with consumer needs.

Consumer insights can include information on demographics, psychographics, purchase behavior, brand loyalty, usage occasions, and product feedback. This can provide a holistic view of the target market and help the company to create more relevant and appealing products, marketing campaigns, and customer experiences.

Furthermore, consumer insights can also help the company to identify new market segments, predict future trends, and assess the effectiveness of current marketing campaigns. They can also help the company to understand the competitive landscape and identify areas where it can differentiate itself from its rivals.

1.3 Channel: A consumer goods channel refers to the various pathways or methods through which consumer goods are distributed and sold to customers. These channels are the intermediaries that connect the manufacturer of the goods to the end-consumer. Consumer goods channels can include retail stores, such as informal traders, online marketplaces, direct-to-consumer sales, wholesale, and direct selling. The choice of channel depends on the type of product, the target market and the company’s overall strategy. Each channel has its own set of advantages and disadvantages, and the company must carefully consider which channel or channels will be most effective for reaching its target market and achieving its business objectives.

1.3 A) Channel analysis tool – segmentation: Channel segmentation is the division of channels into separate parts or sections, based on the qualities they have in common, such as products or service, customers, and outlet space. By segmenting channels, you gain a better understanding of their product mix, service requirements, merchandising opportunities, and value drivers. This allows companies to more effectively reach and target their desired customers. By segmenting their market, companies can better understand their customers, and create more targeted and effective marketing campaigns to improve customer satisfaction and sales.

1.3 B) Channel analysis tool – customer satisfaction: A customer satisfaction survey or voice of the customer survey (VoC) provides insights into customer satisfaction with you and your competitor’s service. It is a survey that businesses use to gather feedback from their customers and ask them questions about their experience with the company, including the quality of products or services, the level of customer service provided, and overall satisfaction with the company. The information gathered through these surveys can be used to identify areas of improvement and make changes to better meet the needs and expectations of customers.

1.4 Competitors: Studying competitors is a crucial aspect of market analysis and strategy development for any organisation. It involves analysing various aspects of a competitor’s business operations, including their products, services, processes, and market activities. This information can be used to identify strengths and weaknesses in the competitor’s offerings and to understand what makes them successful or unsuccessful in a specific informal market.

When studying competitors, it’s important to start by defining the market you are operating in and identifying the key players within that market. This can include direct competitors, as well as indirect competitors that offer similar products or services. Once you have identified your competitors, you can gather information about their products and services. This may include analysing the features, benefits, and pricing of their offerings, as well as any unique selling points they have.

It is also important analyse the processes and systems that your competitors use to deliver their products and services. This may include understanding their supply chain, manufacturing processes, distribution channels, and customer service procedures. Understanding the efficiency and effectiveness of these processes can give you valuable insights into your competitors’ strengths and weaknesses.

Also keep an eye on your competitors’ market activities. This may include monitoring their marketing campaigns, analysing their sales performance, and tracking any changes or shifts in their market positioning. Understanding why your competitors succeed or fail in the market can provide valuable insights into the factors that drive customer behaviour and help you identify opportunities for improvement in your own operations.

1.4 A) Benchmarking analysis tool: Benchmarking is a valuable tool that allows organisations to measure their performance and identify areas for improvement by comparing themselves against other companies in their industry. By analysing key performance indicators (KPIs) and other metrics, companies can gain a better understanding of their strengths and weaknesses relative to their competitors.

The process of benchmarking typically involves selecting a set of relevant KPIs, such as financial performance metrics, customer satisfaction scores, operational efficiency, or market share, and comparing these metrics against those of other companies in the market. This comparison helps companies understand how they are performing relative to their peers and identify areas for improvement.

In addition to KPIs, benchmarking can also involve comparing business processes and practices used by other companies in the market. For example, companies may compare their distribution models in informal markets, customer service processes, or supply chain management practices against those of their competitors. This type of benchmarking can help companies identify best practices and innovative solutions that can be adapted to their own operations.

It’s important to note that benchmarking is not just limited to internal comparisons within the same industry. Companies can also benchmark against best-in-class companies in other industries to gain new insights and identify best practices that can be adapted to their own operations.

1.5 Logistics and distribution landscape: Assessing the logistics landscape is an important aspect of any company’s supply chain management strategy, especially in informal markets. It involves evaluating the various factors that impact the flow of goods and materials from suppliers to customers. These factors may include transportation networks, available warehouses and distribution centers, and the availability of third-party logistics providers (3PLs).

In informal markets, 3PLs are not only third-party logistics providers, but they can also act as wholesalers, providing additional value to companies. Third-party logistics providers are companies that specialise in handling supply chain tasks, such as warehousing, inventory management, and last-mile delivery. Utilising a 3PL can help reduce costs and improve efficiency by outsourcing tasks that may not be a core competency of your own organisation. They can also act as wholesalers, offering a wide range of products and provide access to hard-to-reach areas in informal markets.

When evaluating potential 3PLs, it’s important to consider a number of factors, including their reputation, experience, product knowledge, and ability to meet your specific needs. You should also assess the quality of their warehousing and transportation operations, their technology and systems, and their pricing structure.

1.5 A) Pricing map analysis tool : A pricing map assesses the cost and revenue data of a group of a channel, distribution partners, or consumers. The activity helps to determine different mark-ups in the supply chain and assists with making a business case for a route-to-market model.

The pricing map typically includes information such as the cost of goods, marketing, and distribution, as well as the prices that competitors are charging for similar products or services. By analysing this data, businesses can determine the ideal price point for their product or service that will maximise revenue and profits.

In addition to determining the optimal price point, a pricing map can also help businesses to identify different mark-ups in the supply chain. This information can be used to optimise the supply chain and reduce costs, which can lead to increased profits.

Another benefit of creating a pricing map is that it can help businesses to make a business case for a specific route-to-market model. For example, a business may be considering selling their products through a new distribution channel, and the pricing map can provide the data needed to evaluate whether this is a viable option.

1.5 B) The Product flow analysis tool: The product flow is the study of product movement through the supply chain, from the manufacturer or brand owner to the distributors, wholesalers and ultimately to outlets and consumers. It also looks at the product returns and product rejections, or reverse flow. It is used to gain an understanding of where outlets and channels purchase specific products or product categories from, and whether they purchase from multiple sources.

The product flow analysis looks at the routes taken by products through the supply chain, as well as the various steps involved in the movement of these products. This analysis can help businesses identify any bottlenecks or inefficiencies in the supply chain, which can be addressed to optimise the product flow and reduce costs.

Another important aspect of product flow analysis is the study of product returns and rejections. This refers to products that are returned by consumers or rejected by retailers and must be sent back through the supply chain to the manufacturer or brand owner. This reverse flow can have a significant impact on the efficiency of the supply chain and must be carefully managed to minimize costs and ensure timely delivery of products to customers.

One of the primary goals of product flow analysis is to gain an understanding of where outlets and channels purchase specific products or product categories from, and whether they purchase from multiple sources. This information can be used to identify opportunities for optimisation and cost reduction, such as consolidating orders or negotiating better pricing from suppliers.

1.6 Regulatory environment: It is vital to understand the regulatory factors when entering a country. The laws and regulations of each country can have a significant impact on businesses, affecting their ability to operate, compete, and succeed in the market.

In particular, regulatory factors can impact a company’s route-to-market. For example, they may affect the distribution channels available, the pricing strategy, or the marketing approach used. By understanding the regulatory environment, businesses can identify potential obstacles or opportunities and develop strategies that enable them to navigate these challenges effectively.

Moreover, understanding the regulatory factors is crucial to ensure compliance with local laws and regulations. Non-compliance can result in significant penalties, legal action, or reputational damage. By understanding the regulations, businesses can avoid these risks and maintain a good reputation in the market.

1.7 Technology: It is essential to assess the technology infrastructure when considering entering a new market, particularly in developing countries. Poor and unstable internet supply can be a significant problem and can impact the ability of businesses to operate efficiently. In addition, the high cost of importing technology can be a barrier for companies looking to enter a market.

In many developing countries, the internet supply can be unreliable due to inadequate infrastructure, leading to slow connectivity and frequent disruptions. This can impact business operations that rely on digital platforms, such as e-commerce, cloud-based services, or remote work. Therefore, it is crucial for companies to assess the quality and availability of internet supply in the region they are considering entering.

Moreover, the high cost of importing technology can be a significant barrier for businesses looking to enter a market. Import taxes, customs duties, and transportation costs can make technology equipment prohibitively expensive. Therefore, businesses must assess the cost of importing technology equipment and identify any local suppliers that can provide cost-effective solutions.

To overcome these challenges, companies may need to adapt their technology strategy to suit the local environment. For example, they may need to use low-bandwidth solutions or invest in local infrastructure to improve connectivity. Additionally, partnering with local suppliers can help to reduce the cost of importing technology and ensure that businesses have access to reliable equipment and support.

In addition to assessing the technology infrastructure, it is also important to consider the prevalence of mobile devices and digital literacy in the target market. Mobile devices have become a ubiquitous tool for accessing the internet and conducting business transactions, particularly in developing countries. Therefore, businesses must ensure that their digital platforms are mobile-friendly and accessible to employees and users on the go.

Furthermore, digital literacy is a critical factor in the adoption of technology in many markets. The ability to use and understand digital tools and platforms is essential for businesses and individuals to participate in the digital economy fully. Therefore, it is important for businesses to assess the level of digital literacy in the target market and identify any potential gaps that may impact their operations.

By considering the prevalence of mobile devices and digital literacy, businesses can tailor their technology strategy to suit the local environment. For example, they may need to develop mobile-first applications that are easy to use and accessible to users with lower levels of digital literacy. Additionally, investing in digital literacy training programs for employees and customers can help to promote the adoption of digital tools and platforms.

1.8 Infrastructure: When analysing how infrastructure will impact your route-to-market in a specific country, it’s crucial to consider the condition of the country’s roads, ports, railways, airports, telecoms, and electricity supply. In many emerging markets, inadequate infrastructure can result in significant additional costs for businesses.

For instance, poorly maintained or non-existent roads can make it challenging and expensive to transport goods from one location to another, leading to longer delivery times, increased transportation costs, and even product damage during transit. Similarly, limited or inefficient port facilities can cause delays and additional expenses when importing or exporting goods.

Accessible and reliable telecoms infrastructure is essential for businesses since it enables efficient communication and data exchange. Without such infrastructure, businesses may find it challenging to communicate with clients and partners, resulting in delays, lost sales, and decreased productivity. Furthermore, stable and reliable electricity supply is necessary for businesses to operate efficiently. An unstable or limited power supply can cause costly interruptions to operations and equipment damage.

1.9 External stakeholders: When considering entering a new market, it is important to study how you could collaborate with other external stakeholders in the country. The convergence of profit and purpose has made it essential for companies, governments, and non-governmental organisations (NGOs) to work together towards achieving common goals. Collaboration can help to align development goals and create mutually beneficial outcomes.

Working with other stakeholders in the market can provide opportunities for shared learning, innovation, and access to resources. For example, collaboration with local governments can help to navigate regulatory requirements and provide access to local networks and resources. NGOs can provide valuable insights into the social and environmental context of the market and help to identify areas where businesses can contribute to social impact.

Moreover, collaboration with other businesses can create opportunities for partnerships, joint ventures, and shared expertise. Companies can work together to build local supply chains, share marketing channels, and jointly develop new products and services. Such partnerships can also help to reduce risk and enhance market access by pooling resources and expertise.

Collaboration can also enable businesses to contribute to the development of the communities they operate in. Companies can work with local communities to identify their needs and develop programmes that address their social and economic challenges. For example, businesses can partner with NGOs to develop education and training programmes, provide access to healthcare, or support local entrepreneurs.

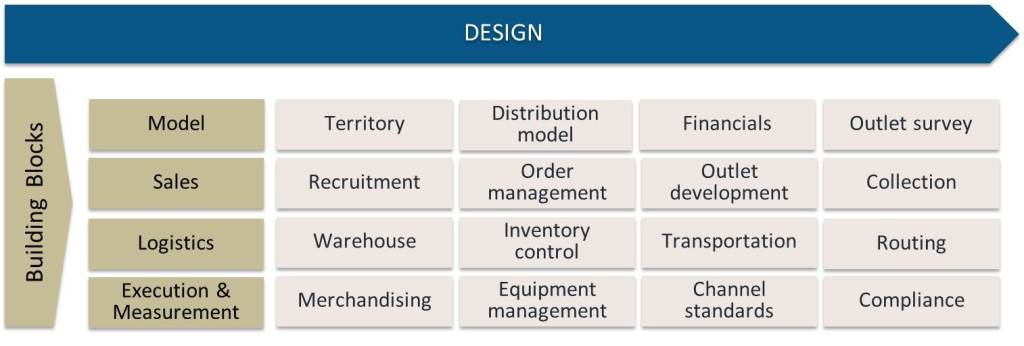

2. Design and enablers

Once you have completed your analysis, you need to start the design process. Our design phase is segmented into four major building blocks that include the model, sales, logistics, and execution & measurement.

2.1 Model

The distribution model building blocks consider the model type, territory, financials and the need for an outlet survey.

2.1.1 Territory: A territory refers to a specific geographic area that a business intends to serve. The size of the distribution territory can have a significant impact on the success of a business. When determining the optimal size of a distribution territory, there are several factors to consider, including the number of potential customers or shops within the area and how easy it is to reach them.

It’s crucial to identify the number of potential customers within the distribution territory. This can be achieved by conducting market research to determine the size of the target outlets, channel type, volume, and location. Knowing the size of the potential customer base helps in deciding the optimal size of the distribution territory, as it will enable businesses to allocate the necessary resources and plan effective marketing strategies.

Another essential factor to consider is the ease of reaching potential customers within the territory. For example, if the distribution territory is in a rural area, it may be more challenging and costly to reach customers compared to an urban area. A business must consider the distribution channels available to them and the cost and feasibility of using these channels to reach customers. This will help in determining the optimal size of the distribution territory, as it will enable businesses to allocate the necessary resources.

2.1.2 Distribution model: Expanding your route-to-market involves crucial decisions regarding your distribution model. You must determine whether to establish your own physical distribution network or leverage third-party providers such as organised distributors and wholesalers. Additionally, it’s essential to consider the level of control you want over certain functions, such as account development and recruitment. The distribution system model you choose will have a substantial impact on the efficiency and effectiveness of your operations. It is customary for distributors to be granted exclusive rights within particular territories and channels.

When considering the option of building your own physical distribution network, you would establish and manage the infrastructure required to distribute your products or services. This involves setting up warehouses, fulfilment centres, transportation systems, and a fleet of vehicles or delivery partners. By owning and controlling these distribution channels, you gain direct oversight over the entire process, from receiving inventory to delivering goods to customers.

Managing your own distribution network allows you to tailor operations to your specific requirements. Moreover, having direct control over account development and recruitment enables you to align the sales strategy with your brand objectives. This level of control can be particularly beneficial when you have unique or specialised products, or when you want to maintain a consistent customer experience throughout the distribution process.

However, utilising third-party providers for distribution offers its own set of advantages. Organised distributors and wholesalers already have established networks, relationships, and expertise in the distribution industry. They can leverage their existing infrastructure, resources, and market knowledge to efficiently distribute your products or services. This can save you time, effort, and capital that would otherwise be required to build and maintain your distribution network.

Working with third-party providers allows you to tap into their established customer base, channels, and territories. They often have a deep understanding of local markets and can navigate regulatory and logistical challenges effectively. By partnering with experienced distributors, you can benefit from their market insights and leverage their relationships to expand your reach.

When selecting third-party providers, it is common to grant them exclusive rights within specific territories and channels. This exclusivity ensures that they have the motivation and incentive to focus on promoting and selling your products over competitors. It also helps to avoid channel conflicts and fosters a cooperative relationship with your distributors.

However, relying on third-party providers may result in a reduced level of control over certain aspects of the distribution process. You may have limited influence over pricing, promotional activities, and customer interactions. Therefore, it is crucial to establish clear communication channels, define performance metrics, and maintain strong relationships with your distributors to align goals and ensure that your brand is represented effectively.

2.1.3 Financials: When considering various distribution models, it is vital to analyse the level of investment required for each option. Additionally, it is essential to understand the trade margins associated with each model and ascertain whether they align with your financial assumptions. Another crucial factor to consider is the profitability of each route-to-market model. Do you possess a clear understanding of the profit potential of each alternative?

Examining the investment aspect of different distribution models is imperative. You should assess the upfront costs involved in building your own distribution network, including expenses such as establishing warehouses, procuring transportation vehicles, and implementing technology systems. Furthermore, when working with third-party providers, it is essential to evaluate the fees or commissions required to engage their services. By carefully analysing the investment requirements, you can ensure that your financial resources are allocated effectively.

Trade margins represent the difference between the cost of your product or service and the price at which it is sold to customers. When evaluating different distribution models, you must determine the impact they have on your trade margins. For example, if you choose to work with organised distributors or wholesalers, they may take a percentage of the selling price as their margin. By carefully examining the trade margins, you can determine if they align with your desired profitability and sustainability.

Profitability is a key consideration when assessing distribution models. You should have a clear understanding of the potential profits each route-to-market can generate. This involves evaluating the expected sales volume, pricing strategy, and associated costs for each model. For instance, if you opt to establish your own physical distribution network, you must consider the costs of maintaining and operating the infrastructure, as well as the potential sales volume you can achieve. Conversely, when relying on third-party providers, you need to analyse the impact of their fees or commissions on your profitability. By comprehending the profitability of each distribution model, you can make informed decisions that align with your business goals.

2.1.4 Outlet survey: An outlet survey is essential in emerging markets as it provides valuable information about the retail landscape and competition. In emerging markets, the retail sector is often fragmented, unregistered, and unorganised, with a large number of informal retailers. Conducting an outlet survey can help companies understand the distribution channels, the number, and types of potential outlets, as well as their locations and sizes.

In emerging markets, where the retail sector may lack formal structures, an outlet survey becomes a crucial tool for companies looking to establish a strong market presence. By undertaking a comprehensive survey, businesses can identify and map the various types of outlets available, ranging from small kiosks to larger stores. This information assists in developing an effective distribution strategy tailored to the specific market conditions.

Moreover, an outlet survey provides valuable insights into the competitive landscape. By assessing the number and types of outlets operated by competitors, companies can gain a clearer understanding of their market share and positioning. This information enables businesses to identify potential gaps in the market and devise strategies to differentiate themselves from competitors.

The survey also sheds light on the geographical distribution of outlets. It allows companies to identify strategic locations for expansion, target specific regions with high market potential, and optimize their distribution network accordingly. Understanding the geographic spread of outlets helps in determining the most efficient and cost-effective ways to reach customers in different areas.

Additionally, the survey provides insights into the sizes of outlets. This information aids in determining the appropriate product assortment, packaging, and pricing strategies for different outlet sizes. It allows companies to tailor their offerings to meet the specific needs and preferences of retailers and consumers in various locations.

Furthermore, an outlet survey can help companies gauge the level of formality and organization within the retail sector. By identifying the proportion of registered and unregistered outlets, businesses can assess the regulatory environment and potential challenges associated with operating in the market. This understanding is crucial for ensuring compliance with local regulations and establishing sustainable partnerships with retailers.

2.2 Sales

The sales building blocks focus on sales, order management, outlet development, and money collection activities.

2.2.1 Recruitment: Start by outlining the goals, objectives, and criteria for identifying and activating new outlets. This includes determining the target market, geographical areas, and specific requirements for potential outlets, such as sales. Evaluate the existing sales team’s capacity and workload. Determine if it is feasible to add outlet recruitment responsibilities to their current roles or if a dedicated team is required. Consider factors such as workload, experience, and availability. If integrating recruitment into the sales team’s responsibilities, clearly define the additional tasks and expectations related to outlet identification and activation. This could involve prospecting for new outlets, conducting initial assessments, and coordinating with other teams or departments involved in the process.

If a dedicated team is needed, create the role of an outlet activator or recruiter. Define the responsibilities, qualifications, and reporting structure for this role. Consider the need for specialised skills in negotiation, market research, and relationship building. Design systematic processes and procedures for outlet recruitment. This includes conducting an every-dealer survey, developing standardised assessment criteria, and establishing a clear workflow for onboarding new outlets.

2.2.2 Order management: Order management involves a range of activities that are important for effectively handling customer orders, whether they are processed manually or electronically, including those from ecommerce platforms. This process encompasses various tasks, such as documentation and tracking, to ensure seamless order fulfilment.

To begin with, order management entails capturing and recording all relevant information associated with customer orders. This includes details like the customer’s name, contact information, shipping address, order items, quantities, and any special instructions provided by the customer. This information is essential for accurate order processing and efficient communication with customers.

Once an order is received, it is important to verify its accuracy and availability of the requested items. This may involve checking inventory levels, confirming pricing and discounts, and ensuring that the ordered products or services are available for delivery or fulfilment.

Documentation is another integral part of order management. This involves generating and maintaining records of orders, invoices, purchase orders, and any related documents. Order tracking is crucial to keep customers informed about the status of their orders. This can be achieved through various means, such as providing order confirmation emails, shipment notifications, or utilising a customer portal where they can view their order status in real time. Tracking orders also enable the identification of any delays or issues in the fulfilment process, allowing for prompt resolution and proactive communication with customers.

In the context of ecommerce, order management includes integrating online shopping platforms with back-end systems, enabling seamless order processing and inventory synchronisation. This integration ensures that orders placed through ecommerce channels are seamlessly transferred to the order management system, minimising manual intervention and reducing the risk of errors.

2.2.3 Outlet development: Outlet development refers to the process of improving the sales, performance and profitability of existing retail outlets. It involves reviewing the current outlet development plan and implementing strategies to generate additional demand, increase sales, and boost profits among existing customers. Some key activities within outlet development include selling new products, negotiating product placement and space allocation, and fostering strong relationships with customers.

Introducing new products to existing customers is an effective way to drive additional demand and increase sales. By identifying customer needs, market trends, and product gaps, you can determine which new products are most likely to resonate with your target audience.

Conducting market research, gathering customer feedback, and analysing purchase data can help in identifying potential product opportunities. Implementing effective product launch strategies, such as targeted marketing campaigns, product demonstrations, and incentives, can aid in driving customer interest and adoption of new offerings.

Within retail outlets, securing optimal space and placement for products is crucial for visibility, accessibility, and sales. In informal markets, space allocation is often managed collectively by the traders themselves and is limited. Engaging with local traders, understanding their norms and practices, and building relationships with them can increase your chances of securing a favourable space. Discuss the potential benefits of your products and how they can complement the existing offerings in the market.

When negotiating space in informal markets, it’s essential to emphasise the value and unique selling points of your products. Clearly communicate how your products can meet the needs and preferences of the local customers and bring incremental value to the market. Provide samples, demonstrations, or testimonials to showcase the quality and appeal of your products.

Building strong relationships with existing customers is essential for maximising loyalty. Engage in regular communication with your customers to understand their evolving needs, preferences, and challenges. Seek opportunities for collaboration and co-creation with traders and the local community. Involve them in decision-making processes, product development, or marketing initiatives. By including them in the development of your business, you show that you value their input and consider them as partners rather than just customers.

2.2.4 Collection: The collection process in informal markets involves mapping out how the payment is received from customers. Depending on the market dynamics and specific circumstances, the collection of payments can be handled in different ways.

In certain informal markets, electronic payment methods are becoming increasingly prevalent. This includes accepting payments through mobile money services, digital wallets, or card transactions. To facilitate electronic payments, businesses need to ensure they have the necessary infrastructure and systems in place. This may involve setting up mobile payment terminals, establishing partnerships with mobile money providers, or using online payment gateways.

However, cash remains a dominant form of payment in many informal markets, and the collection of cash may occur at separate stages from the order placement. This means that customers may place their orders first and then make the payment later. This can happen for various reasons, such as low cash flow or the need to consolidate multiple transactions before collecting cash. It is important to understand and align with the local market practices regarding the timing of cash collection. Communicating the payment expectations clearly to customers and ensuring they are aware of when and where to make the payment can help avoid misunderstandings or delays.

Understanding the specific payment preferences and practices of the informal market is crucial for effectively mapping out the collection process. By offering multiple payment options, aligning with local customs regarding the timing of cash collection, and considering the challenges associated with cash availability, organisations operating in informal markets can optimise their collection processes and provide a seamless payment experience for their customers.

2.3 Logistics

Logistics refers to the overall process of managing and transporting inventory from manufacturing to storage, and to the final destination. The final destination could be an outlet — ready to serve a shopper and end consumer. The logistics building blocks focus on warehousing, inventory control, transportation and routing.

2.3.1 Warehousing & inventory: Warehousing plays a crucial role in the supply chain management process by providing a centralised location for storing goods until they are sold or distributed. Different types of storage areas, such as bulk storage, pallet racking, shelving units, and specialized storage spaces, are utilised based on the nature and requirements of the goods being stored.

Emerging markets may have less developed infrastructure compared to their developed counterparts and this can affect the quality and availability of warehouse facilities. The adoption of advanced warehouse technologies and automation may be slower in emerging markets. Factors such as cost, limited access to technology, and a preference for manual labour may contribute to this. As a result, warehouses in these markets may rely more on manual processes for inventory management and material handling.

Supply chains in emerging markets are less mature and more fragmented compared to developed markets. This can impact warehouse operations, as there may be challenges in terms of transportation, distribution networks, and coordination with suppliers and customers.

Smaller customers may also require more frequent deliveries. Smaller depots located closer to customers enable faster and more efficient deliveries. By strategically positioning depots in proximity to high-demand areas or densely populated regions, warehouses can reduce transportation costs, decrease delivery lead times, and enhance customer satisfaction. This decentralised approach allows for quicker order fulfilment and improved responsiveness to customer needs.

2.3.2 Transportation: Transportation in emerging markets presents unique challenges that require special considerations due to the rapidly changing economic, social, and infrastructural conditions. These markets often face higher volatility, limited infrastructure, regulatory complexities, and diverse cultural norms.

Transportation costs can be higher in emerging markets due to various challenges. Companies need to strike a balance between cost optimisation and maintaining service quality to remain competitive. Last-mile delivery can be particularly challenging in emerging markets, especially in rural areas. Companies may need to explore innovative solutions, such as partnering with local delivery services or using technology to improve last-mile logistics.

Companies need to maintain an optimum fleet size that matches the demand and volume of goods to be transported. Underutilised vehicles result in increased operational costs, while insufficient capacity may lead to delays and customer dissatisfaction.

It is important to build strong relationships with local partners, suppliers, and distributors, as it can significantly enhance the efficiency of transportation in emerging markets. Local partners can provide valuable insights into the market dynamics and help navigate cultural nuances.

2.3.3 Routing: Routing is a crucial aspect of the transportation and delivery process, involving the strategic design of service frequency and delivery routes. The primary goal of routing is to simplify the work for sales and delivery teams while optimising the efficiency of operations. By establishing clear call sequences and maximising the number of standard calls made each day, companies can enhance productivity, reduce costs, and improve customer satisfaction.

Designing an optimal service frequency ensures that customers receive the required goods regularly and promptly. This involves determining the appropriate frequency of deliveries based on customer demand, location, and product characteristics. In emerging markets, a daily delivery might be necessary, while others might only require weekly or bi-weekly visits.

The core of routing lies in creating efficient delivery routes. Companies must consider factors such as distance, traffic conditions, time windows, and load capacity to create routes that minimise travel time and fuel consumption. Leveraging route optimisation software can significantly streamline this process.

Efficient routing leads to cost savings by minimising fuel consumption and vehicle wear and tear. By eliminating unnecessary detours and optimising routes, companies can make the most of their resources and reduce operational expenses.

Routings should not be seen as static plans but as dynamic processes that require continuous evaluation and improvement. Regularly analysing performance metrics and customer feedback can identify areas for optimisation and lead to ongoing improvements in the routing process.

2.4 Execution and measurement

The execution and measurement phase focuses on merchandising, equipment management, channel standards, and compliance.

2.4.1 Merchandising: Merchandising activities include various techniques, including effective product display methods like stock rotation, strategic equipment placement, and the incorporation of compelling point-of-sale materials.

In the context of informal retail setups, space constraints become an important factor. Within these confined areas, optimising product placement becomes important. Retailers are compelled to explore innovative avenues for vertical displays, makeshift shelving solutions, and even hanging arrangements to ensure optimal visibility despite spatial limitations.

Informal retailers often struggle with limited resources to invest in essential merchandising materials, such as signage, displays, and promotional tools. In such instances, collaborations with distributors or suppliers become imperative to provide the required merchandising tools.

A crucial element in the informal retail landscape is the need to align merchandising efforts with the local context. Tailoring product offerings to resonate with local preferences, cultural events, and traditional customs is pivotal in establishing rapport with the community and fostering a sense of connection.

Given that informal markets often attract price-conscious consumers, it becomes essential for merchandising strategies to prominently showcase affordable products. The emphasis should be on highlighting value and affordability through clear and visible price tags, attractive bundled offers, and transparent communication of discounts.

2.4.2 Equipment management: Identify the need for equipment such as racks and coolers, and the placement plan in visible and high-traffic areas to maximise sales. Ensure equipment is clean and well maintained.

Informal retailers often have limited space available, and traders need to make the most of what’s available to them. Equipment placement must be optimised to accommodate both the products being sold and the space constraints of the vendor’s designated area.

Informal markets often lack a structured layout and standardised practices. Informal retailers might set up their stalls or spaces in a haphazard manner, making equipment management more flexible but less consistent. Regulations and compliance standards are often more relaxed or less enforced in informal markets and retailers might have more autonomy in managing their equipment but might also face challenges related to health and safety.

Since informal retailers are less structured, vendors can quickly make decisions to place or adapt to changing circumstances and customer preferences. They can agree to equipment placement and move their equipment around without a lengthy approval process.

2.4.3 Channel standards: Establish execution standards for the sales team while determining the envisioned success for the organisation in the market. Identify the brands and specific Stock Keeping Units (SKUs) that require prominent visibility within the outlet, and strategically designate areas for displaying your products.

Clear guidelines must be established to govern how the sales team engages with customers. This includes tasks such as offering greetings, demonstrating product knowledge, addressing queries, and resolving concerns.

Execution standards play a pivotal role in dictating how products are displayed and organised, as well as ensuring that products are consistently stocked and merchandised to guarantee attractive displays.

In addition, equip the sales teams with an in-depth understanding of the products they are promoting. This knowledge empowers them to effectively address customer questions, provide insightful product recommendations, and establish credibility.

2.4.4 Compliance: Creating comprehensive minimum standards entails an assessment of the fundamental activities carried out by both the sales and distribution teams. This involves establishing clear guidelines, expectations, and performance benchmarks.

For the sales team, these standards could include elements such as time spent in the outlet, adherence to merchandising standards, and effective stock rotation practices. On the distribution side, corresponding guidelines might include efficient inventory management, streamlined order processing, punctual delivery schedules, and accurate documentation practices.

To ensure the consistent application of these standards, implementing an audit system is of importance. This system functions as a monitoring mechanism, enabling the tracking of compliance with the established benchmarks. Particularly for distribution partners, this audit system can be particularly effective. By evaluating aspects like minimum inventory levels, this system ensures that distribution partners maintain adequate stock levels to meet market demand, effectively mitigating the risks of stockouts or the challenges posed by excessive stock.

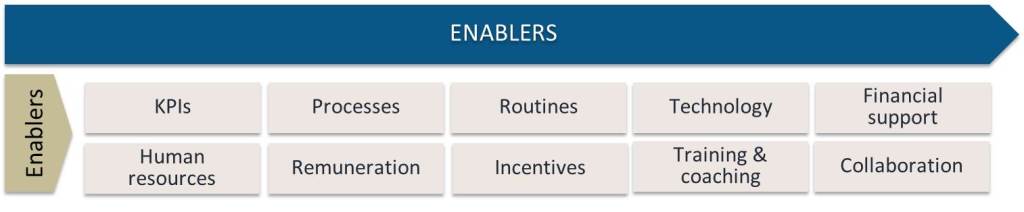

3. Enablers

The final activity of the design phase is to develop the key enablers to support the building blocks.

3.1 Key performance indicators:

Key Performance Indicators (KPIs) are quantifiable metrics used to assess the performance of a business or specific activities within it. KPIs track important aspects of the business, identify areas for improvement, and provide actionable insights for decision-making. KPIs provide a data-driven approach to decision-making. Rather than relying on gut feelings, decisions are based on concrete metrics, leading to more informed and effective choices. KPIs facilitate communication within the organization and provide a set of metrics or common language and understanding for stakeholders to discuss performance and objectives.

The following KPIs are worth considering (not exhaustive):

Outlet penetration: Measuring the extent of market coverage.

Outlet coverage: The number of outlets a salesman visits in a sales territory.

Product availability rate: Ensuring consistent product availability at outlets.

Sales conversion rate: The percentage of outlets at which a salesman makes a sale.

Order accuracy: The percentage of orders that are accurately fulfilled and delivered as requested.

Delivery completion rate: Indicating the success of delivery processes.

Product return rate: The percentage of products returned by outlets due to issues like damage or defects.

Customer retention rate: Demonstrating customer loyalty and satisfaction.

Market share: Highlighting the market presence of the organisation.

Customer feedback and ratings: Gathering feedback from outlets to gauge satisfaction levels and identify areas for improvement.

3.2 Process mapping:

In route-to-market, process mapping refers to visually outlining and comprehending the sequence of steps involved in selling products or services and distributing them to retailers or customers. It involves creating a roadmap that guides the entire journey from the point of receiving an order to delivering the product to the customer.

This mapping process involves breaking down the tasks and activities required at each stage, such as order placement, inventory management, order processing, packaging, shipping, and customer delivery. By doing this, the organisation can identify potential bottlenecks, streamline operations, and ensure that every aspect of the sales and distribution process runs smoothly.

Furthermore, process mapping in a sales and distribution business highlights decision points, such as when to restock inventory or which shipping method to choose. It also reveals the interactions and dependencies between different teams and departments, such as sales, warehouse, and distribution.

3.3 Routines: Sales and distribution routines in a route-to-market help in establishing a predictable sequence of actions that can lead to efficiency, consistency, and help the sales team achieving particular goals. An example of sales routines could be:

- Prospecting: Identifying potential retailers, wholesalers and distributors.

- Order taking: Taking and processing customer orders.

- Merchandising: Merchandising products on shelves to catch the eye and make them easily accessible.

- After-sales support: Providing ongoing support and addressing concerns or complaints.

3.4 Technology: In emerging markets, the digitisation of supply chains through smartphones, mobile applications, and cloud-based software can provide efficiency and real-time visibility. These technologies automate routine tasks, such as inventory management and order placement, thereby simplifying operations in emerging markets. They also offer real-time tracking and data analytics, which bring transparency and actionable insights even to the smallest outlets. Examples include:

Order placement and tracking: Retailers can place orders via an app, simplifying often cumbersome processes involving phone calls, paper documentation, and manual data entry.

- Automated Inventory Management: Mobile applications can scan barcodes or QR codes to quickly update stock levels, thereby reducing the time spent on manual counting.

- Route optimisation: GPS-enabled devices can help in plotting the most efficient routes for supply chain logistics, saving both time and fuel costs.

- Digital payments: Cloud-based payment solutions make transactions swift and transparent, reducing the need for cash handling and the risks of fraud.

- Data Analytics: Cloud-based analytics tools can provide real-time insights into sales trends, inventory levels, and customer behaviour.

3.5 Financial support:

The primary objective is to identify the financial needs of retailers and smaller distribution partners, especially in emerging markets, and to offer tailored support solutions. This involves exploring partnerships with financial institutions and fintech providers focused on small-to-medium enterprises (SMEs).

SMEs, particularly in emerging markets, often lack formal financial records. An absence of an established credit history makes them ineligible for traditional financial support. Financial institutions find it risky to invest in such unknown entities, and traditional financial models may not be accessible or suitable for SMEs in remote areas.

Potential solutions could include:

- Conducting a thorough financial audit of the retailers and distribution partners

- Developing a financial model that can accommodate variable levels of documentation

- Exploring microfinancing solutions that offer smaller, more manageable loans

- Shortlisting financial institutions and fintech companies with a proven track record in handling SMEs

- Partnering to develop custom financial products specifically designed for SMEs in emerging markets

- Leveraging fintech solutions to streamline payment processes, provide real-time financial insights, and automate credit assessments

3.6. Human resources: Consider the acquisition and retention of skilled staff. Create the right environment for employees to learn and grow and put the right policies in place. Issues to consider:

- Local knowledge: In emerging markets, an understanding of local culture and consumer behaviour can be as valuable as formal qualifications. Consider recruiting locally to tap into this wealth of knowledge.

- Skill adaptability: Given that many candidates may not have formal training or previous employment in structured corporate settings, adaptability and the ability to learn on-the-job may be prioritised over formal qualifications.

- Language skills: Multilingual abilities could be an asset if the market consists of diverse linguistic groups.

- Informal recruitment channels: Traditional recruitment channels may not be as effective. Consider tapping into local community networks or social organisations for referrals.

3.7 Remuneration and incentives: Determine the sales compensation, including base salary, commission, and additional monetary incentives. Set incentives based on execution and compliance standards for the sales and distribution team. The remuneration package may need to factor in additional incentives or allowances for employees who have to work in challenging conditions. Also consider providing incentives for high customer retention rates.

A well-designed compensation plan can serve to motivate your staff, align their goals with that of the organisation, and ultimately drive increased revenue and profitability. The structure typically consists of a combination of base salary, commission, and additional monetary incentives. Further, incentives can also be set based on execution and compliance standards.

3.8 Coaching: Develop coaching programmes and equip employees with the tools and knowledge to complete their tasks in the workplace.

Addressing skill gaps: As emerging markets are in a transitional phase, there often exists a mismatch between the skills of the workforce and the requirements of modern organisation. Coaching helps bridge this gap, ensuring that employees are equipped with the competencies necessary to meet market demands.

Culturally relevant training: A generic, one-size-fits-all approach might not work in the diverse cultural contexts of emerging markets. Coaches with an understanding of local customs, values, and business practices can tailor training to be more effective and relevant.

Employee retention:The competition for talent in emerging markets can be fierce, given the rapid growth and opportunities available. Coaching can play a role in talent retention, as employees often value personal and professional development opportunities. It shows that the company is invested in their growth.

Enhancing productivity: The productivity levels in emerging markets can sometimes lag behind developed economies. Coaching that focuses on best practices, efficient processes, and time-saving measures can drive up productivity levels.

Tailored development: Each employee has unique strengths and areas for improvement. A coaching programme offers bespoke training that addresses individual needs.

Coaching process:

Skills audit: Identify the current skillset of the employee. This could be achieved through surveys, self-assessments, or feedback from peers and supervisors.

Gap analysis: Understand the discrepancy between the employee’s current competencies and the required level for optimal performance.

S.M.A.R.T goals: Ensure that the goals set are Specific, Measurable, Achievable, Relevant, and Time-bound.

Action planning: Develop a clear roadmap for achieving the set goals. This might include training sessions, workshops, or self-paced learning.

Regular check-ins: Arrange periodic meetings to discuss progress, challenges, and any adjustments needed.

Measuring progress: Utilise metrics and performance indicators to track how well the coaching programme is translating into improved performance.

3.9 Training: Implement training programmes to increase knowledge and skills of employees. For sales staff this could include product knowledge, merchandising skills, and how to handle objections in the market.

Needs assessment: Before implementing any training programme, it’s important to carry out a needs assessment. This will identify the gaps in knowledge and skills among employees.

Customised content: The content of the training programme should be tailored to the specific needs of the organisation and its employees.

Product knowledge: Comprehensive understanding of the product or service they’re selling is crucial. This includes features, benefits, and how it stands out from competitors.

Merchandising skills: Train staff on effective product displays, promotional techniques, and the reasons behind product placement.

Handling objections: Salespeople will face objections from potential customers and training should include strategies for addressing common objections, understanding customer concerns, and turning these objections into sales opportunities.

Continuous feedback & adaptability: Given the dynamic nature of emerging markets, it’s essential to maintain a feedback loop with the sales and distribution teams. They’re on the frontline and can provide real-time insights into market shifts.

3.10 Collaboration: Identify organisations and businesses that you could collaborate with. Businesses, government and non-profit organisations all have rich networks and can play an important role in facilitating relationships. Collaboration could lead to cost savings, resource pooling, and reduced overheads on projects.

Shared Investment and risk: By pooling resources for mutual projects, both parties can significantly reduce individual costs. Collaborative ventures often mean that risks are shared, leading to more cautious and well-informed decisions.

Shared warehousing: Companies can reduce overheads by jointly using a warehouse, especially if their production or demand cycles are complementary.

Rich networks: Each collaborator brings its own network of contacts, stakeholders, and partners, opening doors to further opportunities.

Policy development: Collaborate with stakeholders to shape industry regulations or standards, ensuring they’re practical and beneficial.

Social initiatives: Businesses can partner with Non-Governmental Organisation (NGOs) for corporate social responsibility (CSR) projects, increasing social impact and reach while enhancing their own brand reputation.

Grassroots Expertise: NGOs often have deep insights into local communities, which can be invaluable for businesses looking to expand or adapt in those areas.

4. Pilot & scale

The third and fourth phase focus on piloting and scaling your route to market model.

4.1 Pilot

A pilot project or initial small-scale implementation, tests the viability of a route-to-market model. The pilot project enables an organisation to manage the risk of a new model, identify problems, and make changes, before committing substantial resources.

Select a test area: Instead of launching across the entire market, pick a specific region, city, or neighbourhood that closely represents the broader market’s characteristics.

Feedback collection: Implement mechanisms to gather feedback from both consumers and distributors. Understand any reservations or concerns they might have and address them. This could be through surveys, focus groups, or direct interviews.

Evaluate and refine: Regularly monitor sales data, customer feedback, and other relevant metrics. Identify what worked well, what didn’t, and the reasons behind it.Make necessary adjustments in real-time based on the feedback and initial results. This could involve tweaking the route-to-market model, product, adjusting pricing, or changing promotional tactics.

Document processes and learnings: Ensure that all processes, insights, challenges, and successful strategies are documented. This will be invaluable when replicating the model in other markets or when revisiting the same market with a different product.

4.2 Scale

Scale involves expanding the model, increasing sales, servicing more customers, impacting more entrepreneurs, creating more jobs, and selling more brands and products.

The project team can scale the model, once the pilot launch has been completed and the necessary changes have been made to it. During this phase you will also identify the barriers to scaling the model and identify steps to overcome these barriers.

Scaling a business or route-to-market model presents multiple challenges. Financial and human resources constraints can limit expansion activities, and inefficiencies in processes or systems that work at a small scale might become problematic as operations grow. It could also be difficult to replicate success from one market in another due to differences in consumer behaviour, preferences, or competition.

Continuous monitor: Use performance metrics and KPIs to monitor the RTM model’s success continuously. Be prepared to make changes based on real-world performance.

Risk management: Scaling introduces new risks and establish a risk management strategy to anticipate, monitor, and mitigate potential challenges.

Continuous updates: Ensure that the document remains a living entity. As the scaling progresses and even after its completion, continuously update the documentation with new porcesses, learnings, challenges, and solutions.

Evaluate & refine: Periodically pause to evaluate the scaling process’s success. Ensure that the RTM remains effective, efficient, and aligned with the organisation’s objectives.Make refinements as needed based on these evaluations.

Framework

For a complete framework and steps to design and develop a route-market plan, see our Route-to-Market presentation (220+ slides). It discusses each step in analysing, designing, piloting, and scaling a route-to-market model to service micro-retailers, and includes 18 tools to analyse the market and design processes. The presentation also includes 35 case study snapshots of companies and startups in Africa, Asia and Latin America — employing business models to service customers in emerging markets.